Individual Voluntary Arrangement (IVA)

Clear unsecured debts with the help of an IVA

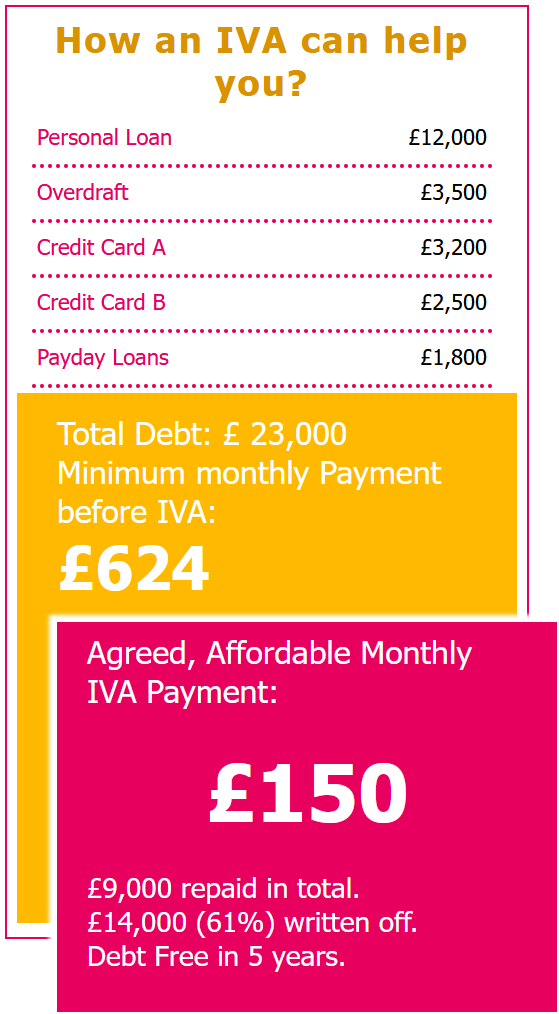

If you are struggling with unsecured debts of £10,000 or above, an IVA (Individual Voluntary Agreement) could be the financial lifeline you are looking for.

An IVA is a legally binding agreement between you and your creditors and, if accepted, it can mean avoiding bankruptcy. However, you will be expected to pay back what you can afford, outside of reasonable living costs, towards your debt over a five year period.

After five years, the remaining balance of your debts will be written off.

Once agreed with a licenced Insolvency Practitioner (IP), all interest and other charges will freeze and creditors can no longer pursue you for payment.

In addition, you will:

Write off up to 70% of your debt

Lower your monthly payments

Stop phone calls or letters from creditors

However, although assets such as homes and cars are typically safeguarded, you may be obligated to free equity from your home to contribute towards your debt.

In addition, you must be aware that your financial circumstances will be reviewed every year to gauge any changes in your situation.

Take control of your debts today with an IVA

If you are struggling with monthly payments, and only paying the interest and charges on credit cards and loans, don’t worry, you’re not alone – but it is time to take action.

Here at Money Debt and Credit, we have helped countless numbers of people climb out of situations just like yours by providing straightforward advice.

That’s why, if you’re battling with bills and your unsecured debts are over £10,000, an Inidividual Voluntary Agreement may be an option for you.

To get started, all you need to do is tell us the details of your situation and we can give you a free 30-second report that will make sure you are provided with the ideal solution.